I’m going to let you in on one of the stock market’s most Powerful secrets that many traders are unaware of.

It’s a way to generate amazing gains while at the same time reducing your risk compared to what most novice traders do. That’s because most novice traders don’t know how to do more than buy and hold.

A strategy called a Credit Spread can make a huge difference for many traders, and it’s the bread and butter trade of so many successful traders.

Credit Spreads not only limit your risk, but they also let you take profits up front! That’s right… in fact, the challenge Credit Spread traders have is not to make money at the end of the trade, as they do in other types of trades. The challenge is to hold onto the gains they take in at the start of the trade.

And while it’s fun to get paid up front, bringing in money at the start of a trade has an incredibly powerful advantage: we get to use the money we take in at the start to improve the trade.

Let me explain.

First, let’s talk about risk in the market, which is basically how much you can lose in a given trade. If you outright buy a stock, your risk is what you pay for that stock, and of course, any commissions you pay. If you own XZY and XYZ drops suddenly, all the money you put in could be lost.

What if you could instead have the ability to generate income from XYZ, with only a fraction of the money that is required to buy a high-priced stock outright? What if you could reduce that risk from being the entire investment to just a tiny fraction of the full value of the stock?

A Credit Spread lets you limit your risk AND your required capital by buying and selling in that market at the same time. The prices at which we buy and sell is different, and your risk is typically the difference between the buy and sell price, rather than the full price of the stock. And with Credit Spreads, we bring in some profit right up front, which further decreases that risk, sometimes substantially.

An Example

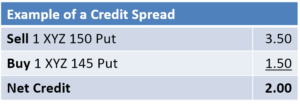

For example, let’s say you believe XYZ is going up. You can sell an option around the current price, and then buy an option at a lower price. Traders call these buy and sell prices the “strike” prices. A typical difference between the strike prices of the options might be $5. That defines your spread risk at $5 per option you buy, but it gets even better.

Let’s say you sell an option and take in $3.50, and buy the lower-priced option which costs you $1.50. That’s a difference of $2, and it’s what you pocket when you create the spread (less commissions, of course. For clarity, we’ll omit commissions in the remaining discussion).

Because you’re taking in money at the creation of the spread trade, we call it a “credit” spread. Since you take in $2 at the time you open the spread, you decrease your spread risk by the $2 you take in, making your effective risk just $3 rather than $5.

You can see in the image that we’re buying and selling “Put” options. For those new to Put options, it may help to know they’re actually a form of insurance.

New traders are often surprised that they’ve been buying Puts for years. When you buy homeowner’s or renter’s insurance, you buy a contract that will pay to cover any loss in value of your home due to fire, theft, etc. You pay a premium for this insurance, and there’s a time limit when the contract expires each year.

A Put option is similar, in that we can buy a put, and if the stock price drops below the put price before the expiration date, the put’s value rises to make up the difference. Just like insurance.

In our put option spread, we’re selling an insurance contract, as well as buying one, and netting a profit when we buy both.

When Does the Trade End?

So how does the trade complete? We generally just hold onto the contracts and wait. As long as the price stays above your sold strike price at the time of “expiration” when the option contracts expire, you’ll be able to keep the premium you collected.

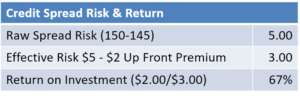

If the price does drop, then the most you’ll have to pay per option is $3, which would be the difference between the strike prices ($5), less the initial premium you took in ($2). Your effective risk is really just $3 per  contract.

contract.

This all works because you bought a put that was less costly than the one you sold, which gave you a net credit to apply toward the risk. If price drops below your purchased put, you can recover any further losses as the purchased put value rises.

Reducing Risk is a BIG DEAL!

That reduction in risk by bringing in money up front is a big deal and a great value! In this example, it’s a 40% reduction in risk just for getting the trade in place. And though making $2 on $5 is a great return on your investment, making $2 on $3 is even better. Way better – about a 67% return – which is a 57% improvement!

A note on our comparison between a homeowner’s insurance policy and a Put option. While a house policy usually lasts a year, an option contract can be much, much shorter. A typical spread contract timeframe might be a month, though It can even expire in much shorter or longer time frames. There are many different option time frames to select from, anywhere from days to years. So, you have a wide variety of approaches to choose from.

So now that you have an idea how Credit Spreads work, let’s talk more about what makes them so powerful.

The Power of Credit Spreads

Probably the most amazing aspect to new spread traders is this: even if your stock doesn’t actually go up, we can still make the same amount. A well-placed Credit Spread can be profitable even if the market doesn’t rise. In fact, it can even drop a little and still bring in the same amount.

If you didn’t quite catch that, let me repeat it a different way. You can craft a Credit Spread that remains profitable whether the market goes up, stays the same, or even drops a bit.

That Credit Spread POWER is enough to get most traders interested. But we’re just getting started with understanding the power of these amazing trading mechanisms.

Credit Spreads let you get your money working harder for you. Since you don’t need the full $5 difference between the stock prices, Credit Spreads give you the ability to buy even more Credit Spreads in this market, or other markets. More of your capital is freed up to make other investments. That means you’ll be able to grown your account faster to reach your goals.

And as you saw above, making $2 while risking $3 is a 2 out of 3 return, or about 67%. If you can do that in a month, or even two months, we’re talking some amazingly powerful accumulation. Even without compounding, a strategy that makes 67% every two months over the course of a year adds up to a whopping 402% before compounding. That’s like doubling your investment TWICE in a single year.

With a system, you’ll be able to repeat this process again and again as you work your way through the year. You can identify the safe entries that provide sufficient gains and place your trade. When that trade completes, you set up the next month’s trade, as shown here. Trade, rinse, repeat. You get the idea. And when you see it this way, you understand how powerful it is to have more capital to work with as your account grows. And all this happens without risking the entire value of the stock as you would with traditional buy and hold.

You Don’t Even Need A Huge Trading Account

Frustrated by a small account? With Credit Spreads, you can participate in a high-price stock’s movement even if you don’t have the capital to buy a lot of shares. As an example, GOOGL recently traded at well over $1,000 per share. You’d need over $5,000 free in your account just to buy 5 shares. If GOOGL then goes up by $10, you’ll pocket $50 before commissions (5 shares x $10), for a measly 1% return, not to mention you’d have all $5,000 at risk when in that trade. With Credit Spread techniques, you can control 20 times as many shares for a fraction of the cost of a single share. And that would be trading just one contract!

In this way, Credit Spread traders know how to take advantage of movement in a market even if their account can’t provide the capital to buy the stock. Have you been hesitant to trade GOOGL, AMZN, or other $1K+/share stocks because of the price even though they’re always in the news spotlight? Did you believe you can’t trade stocks priced $1,000+ per share with a small account? You absolutely can, with the power of Credit Spreads.

If you’re following this, and I hope you are, you are starting to see why so many traders just love Credit Spreads. Compared to buying stocks, where you can only make money when the price rises, Credit Spreads have the potential to make money if the price doesn’t rise a penny.

I hope I’ve got your interest now. I hope you can start to see some of the potential, and the power.

Having a System is Key

Now of course, not every trade will work out. You cannot just buy and sell any option and expect it to perform flawlessly, as nice as that would be. What’s key is to know how to select the right stocks as well as the right option prices to keep the odds in your favor. Ideally you want to maximize your return without having price come anywhere near your strike prices.

Like all things in the market, there are techniques, tips and tricks. Profitable traders know it takes a system to achieve consistent gains in the market.

Many traders take years to learn these on their own through trial and error.

Many have spent a lifetime perfecting the clear system you need on how to select markets, strike prices, etc., in order to maximize your chance of success in each and every trade. Plus, you want to have defensive strategies ready to go in case the market unexpectedly moves against you. (Remember, we are traders and we know how the market can be!)

One way to accelerate your learning so you can begin to control the Power of the Credit Spread, is to learn from someone who’s profitably trading them day in and day out, with years of experience in working with them. Someone who knows which markets work best, and which tools are needed to set and manage the trades, and how to defend your trades when the market moves in unexpected ways.

But where can you find a mentor with the right experience and materials to get you up to speed? Base Camp Trading has one of the world’s best Credit Spread traders, who’s mentoring his students on a daily basis. They refer to him as the “Options Genius”. His #1 Selling Trading Guide, “The Ultimate Income Trading System” is yours FREE, via this link.

They refer to him as the “Options Genius”. His #1 Selling Trading Guide, “The Ultimate Income Trading System” is yours FREE, via this link.

The Options Genius not only shows you how to select and manage your own trades, he even lets his students look over his shoulder when he makes his own trades. That’s right! As you’re learning, you’ll have the ability to see his trades live, or even get them sent to you via email or text. But I’m getting ahead of myself here.

So, before you jump into that next buy and hold, know that there are some other ways to trade that you perhaps didn’t know about. Once you learn them, you’ll wonder how you ever got by without them. Start with the FREE e-book to learn more about the Options Genius’ strategies, and get ready to change the way you trade with the incredible power of Credit Spreads.

Risk Disclaimer:

©2010-2019 MicroQuant℠ Patented – U.S. Patent No. 7,461,023 and other Patents Pending

IMPORTANT NOTICE! MicroQuant, LLC (MQ) does not hold itself out as an investment adviser or a commodity trading advisor. All information and material provided by MQ, including www.basecamptrading.com, is for educational purposes only and should not be considered investment advice. Any opinions, research, analysis, prices, or other information contained in this material is provided as general market commentary and does not constitute investment advice or a solicitation to buy or sell any securities. Trading and investing are inherently risky activities and should only be undertaken by persons capable of accepting such risk and a possible loss of all the capital they commit to such activities, and in some cases even more. The information shown is for illustrative purposes and is not meant to represent any actual trading or investing results. No representation is made that any person using the services of MQ will be profitable or will not incur losses. Past performance is not necessarily indicative of future results.

NO REPRESENTATION IS BEING MADE THAT THE USE OF THIS STRATEGY OR ANY SYSTEM OR TRADING METHODOLOGY WILL GENERATE PROFITS. PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS. THERE IS SUBSTANIAL RISK OF LOSS ASSOCIATED WITH TRADING SECURITIES AND OPTIONS ON EQUITIES. ONLY RISK CAPITAL SHOULD BE USED TO TRADE. TRADING SECURITIES IS NOT SUITABLE FOR EVERYONE. DISCLAIMER: FUTURES, OPTIONS, AND CURRENCY TRADING ALL HAVE LARGE POTENTIAL REWARDS, BUT THEY ALSO HAVE LARGE POTENTIAL RISK. YOU MUST BE AWARE OF THE RISKS AND BE WILLING TO ACCEPT THEM IN ORDER TO INVEST IN THESE MARKETS. DON’T TRADE WITH MONEY YOU CANNOT AFFORD TO LOSE. THIS WEBSITE IS NEITHER A SOLICIATION NOR AN OFFER TO BUY OR SELL FUTURES, OPTIONS, OR CURRENCIES. NO REPRESENTATI ON IS BEING MADE THAT ANY ACCOUNT WILL OR IS LIKELY TO ACHIEVE PROFITS OR LOSSES SIMILAR TO THOSE DISCUSSED ON THIS WEBSITE. THE PAST PERFORMANCE OF ANY TRADING SYSTEM OR METHODOLOGY IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS.

CFTC RULE 4.41 – HYPOTHETICAL OR SIMULATED PERFORMANCE RESULTS HAVE CERTAIN LIMITATIONS. UNLIKE AN ACTUAL PERFORMANCE RECORD, SIMULATED RESULTS DO NOT REPRESENT ACTUAL TRADING. ALSO, SINCE THE TRADES HAVE NOT BEEN EXECUTED, THE RESULTS MAY HAVE UNDER-OR-OVER COMPENSATED FOR THE IMPACT, IF ANY, OF CERTAIN MARKET FACTORS, SUCH AS LACK OF LIQUIDITY. SIMULATED TRADING PROGRAMS IN GENERAL ARE ALSO SUBJECT TO THE FACT THAT THEY ARE DESIGNED WITH THE BENEFIT OF HINDSIGHT. NO REPRESENTATION IS BEING MADE THAT ANY ACCOUNT WILL OR IS LIKELY TO ACHIEVE PROFIT OR LOSSES SIMILAR TO THOSE SHOWN.