This is where having a good feel for the fundamentals and technicals of a market can really pay off. Sometimes prices get overextended, either to the upside or downside, for no good reason. If you believe that a market has solid bullish fundamentals and supporting bullish longer-term technicals, then prices trading within the significantly undervalued range can represent an excellent low-risk entry point. As stated previously, buying simply because a market is trading within the significantly undervalued zone is not advised, especially in situations where downside momentum is increasing. And buying into a flash crash can be lethal to your trading account. However, when trading with other effective market analysis tools, prices trading within the significantly undervalued zone can represent an excellent opportunity.

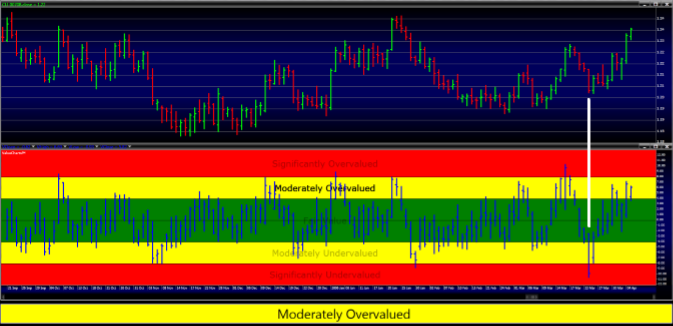

Days Following Significantly Undervalued Prices

In the case above, the Euro currency prices within the significantly undervalued zone represented an excellent buying opportunity. Knowing the valuation of the Euro currency market in this case was very valuable information that could have led to meaningful profits!

Moderately Undervalued Zone The moderately Undervalued zone represents undervalued prices within a ValueChart®. In general, 16% of trading activity occurs within or below this zone. Sellers need to be aware that prices within this zone are undervalued should therefore use caution when selling short within this valuation zone. Similar to the significantly undervalued zone, this zone can represent an attractive place to buy into a market or take profits from a short sell. The same cautionary language applies here as well, however. I would not recommend buying into a market simply because it was trading within the moderately undervalued state.

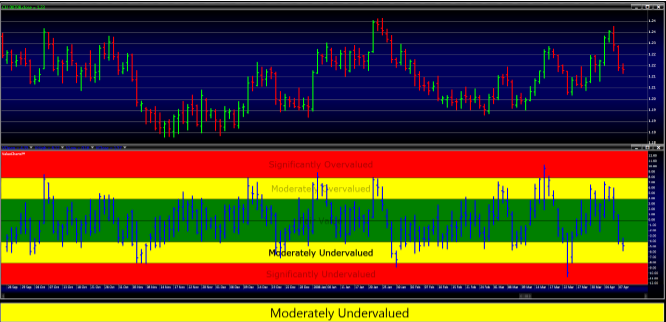

Euro Currency Futures trading within the Moderately Undervalued Zone

Days Following Moderately Undervalued Prices

As you can see in the chart above, the days following the moderately undervalued prices witnessed a strong surge to the upside. With practice, a trader or investors can use ValueCharts® with deadly accuracy when entering or exiting markets.

To learn more about how to trade with ValueCharts click here