You’re looking at your 401K and wondering where the value went. It was up so high, and now it’s losing value as the economy isn’t doing as well as it was. You wonder what you can do to help your portfolio get back in gear and growing.

Many traders have heard about bonds, and that they can help when the markets aren’t rising. Though they hear others talking about bonds, they don’t quite know how to take advantage of them, or perhaps even know what bonds are.

The bottom line is that bonds often increase in value when the stock market decreases in value. That’s why bonds are considered a “risk off” strategy, meaning that many traders move to bonds when they want to reduce their portfolio risk. They also move money back into the stock market once the stock market starts to recover.

Many knowledgeable traders do exactly that, move money between stocks and bonds as the market climate changes. When the stock market is rising, they move money into the stock market. When the stock market is falling, they sell their stocks and buy bonds. Many funds manage their risk by moving into bonds when the market turns down.

In fact, many traders who believe they’ve properly diversified their portfolio are missing bonds as a key factor in true diversification. Ask just about any financial adviser about creating a diversified portfolio, and undoubtedly, bonds will be a big part of that discussion.

It makes sense to know how to make bonds a part of your own portfolio.

But many traders struggle with how to do so. They get overwhelmed with the details that bonds can bring. And for good reason. We would get into all kinds of details on bonds, and obscure terms like par value, handles, yields, maturity, discount rates, coupon payments, and more.

What if you were to learn that while Bonds can get a bit complex, it’s actually easy to trade them?

What if you were to learn that while Bonds can get a bit complex, it’s actually easy to trade them?

Understanding ALL the Complexity Is NOT Required

You don’t have to understand all those complexities to trade bonds. Like a car, you don’t have to understand all the details of how an engine works to be able to drive. You need to know how to get the car to move, stop, and turn.

That’s the same thing we need to know to trade bonds – when to get in, and when to get out, and how to anticipate those events. We can trade bonds without having to worry about those additional complex details.

For example, we can trade a bonds Exchange Traded Fund, or ETF, that we trade just like any other ETF. That’s right, we can get in and out of a bonds ETF, just like we get in and out of a stock like AAPL. You’ll likely pay similar commissions as you would with other ETFs, and you will have no liquidity issues, meaning that it’s easy to get into and out of them.

Bonds ETFs, like TLT, trade pretty much just like a stock. You can chart them like a stock, and analyze them like a stock. That is, you can find breakouts at support and resistance. You can draw a pivot-based trendline to identify potential breakouts. You can do just about any other common stock-based method of entry and exit with and ETF like TLT.

Now it does help to know which market to trade, as there are different ETFs. A recent publication listed well over 300 different bonds ETFs. The one we’ve mentioned above, TLT, is based on the 20+ Year Treasury Bond, and is an iShares product. That means that it should closely track the performance of public US Treasury bonds that have a remaining life span greater than 20 years. That is, bonds that are going to be around for 20 years or more.

This is in comparison to shorter-term bonds, that may only exist for 2 years, or for 5 years. Rather than get into a lot of details about maturity etc., one way to think of bonds is to relate them to CDs at your bank.

These “Certificates of Deposit” give you a specified return as long as you hold onto them for the required timeframe.

When you set up a CD, you determine the timeframe in months or years, and then agree to the rate of return that the bank is offering. For example, you may get a 6-month CD that pays you a 2% return, or you may select a 3-year CD that pays a 3% return. Of course, these rates vary based on many factors, but you usually get a better rate of return if you make a longer-term commitment to keep your money at the bank and in that CD.

Similarly, with bonds, you may expect to get a better rate of return on your bond if you commit to a longer period. If you look at what is being held by TLT, for example, you’ll see that it’s a mix of different timeframe holdings, all of which should have duration of 20 years or more.

What’s TLT Comprised Of?

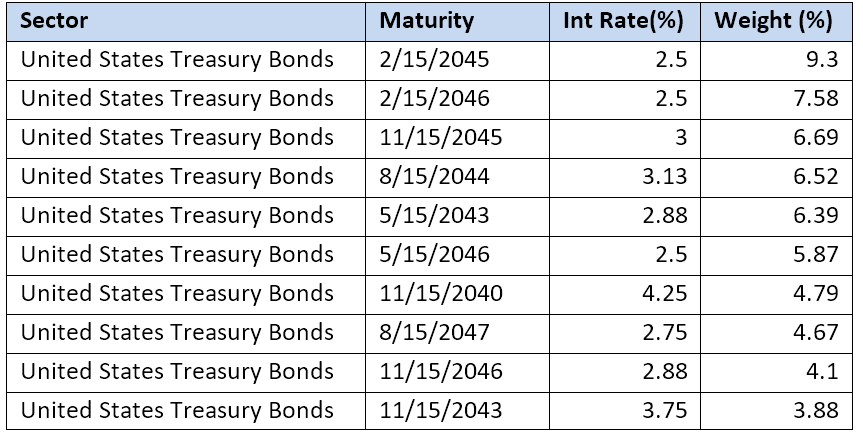

In a recent snapshot, the top 10 holdings of TLT were as shown in the table shown here.

Each row in the table represents a different holding that TLT has at the time of this snapshot. You can see that each has an expiration date (Maturity) that is at least 20 years from now. You can see that each of those differently-timed holdings have a different rate of return.

The final column shows what percentage of the total TLT investment is held in that specific bond, also known as the Weight. You can see that almost 10% of TLT was invested in a US Treasury Bond with a 2.5% interest rate that expires in February of 2045.

And by the way, this is why bonds are often referred to as “Fixed Income”, because each of those bonds that TLT is holding have a fixed rate of return.

When you’re trading or investing with TLT, you’re actually getting a blend of a selection of longer-term bonds, rather than holding one specific bond. When working with TLT, you’re not only simplifying the buying and selling of bonds within your portfolio, you’re also getting bonds diversification, as you’re working with many different actual bonds, interest rates, and dates.

What’s important to consider is that TLT is made up of longer-term bonds. They tend to take a longer-term perspective, and may smooth out the ups and downs of the markets a bit. But TLT can still be influenced by interest rate changes, among other factors.

So we’re not expecting TLT’s price to stay the same. Actually, it’s far from being stagnant! Remember that trading is not just about what the value of the underlying is, it’s also about speculation: whether people think it’s likely to go up or down in the next time frame.

That’s similar to trading AAPL. Yes, part of the value of AAPL is the current worth of the company, but speculation about products, management, supply, demand, issues, and so much more also factor into the price, even if the underlying value of AAPL’s assets doesn’t change. TLT has many economic and bonds-related factors that influence its price on a daily basis.

Therefore, when we trade TLT, we want to be wise in our entry. We want to do our best to buy when it’s relatively undervalued, and sell when it’s relatively overvalued. Just like when we say we want to buy AAPL, it’s prudent to buy on a dip, when the value is down before anticipated growth.

It’s the timing that’s key. It’s important to know when it’s a good idea to consider bonds, and also when to actually place the order to jump in.

Technical vs. Fundamental Analysis

One way to identify a good entry in bonds is through technical analysis, which primarily relies on the chart’s reflection of past movement. Many other traders use this technique, so traders often equally anticipate rises and falls in the market as price moves past key chart levels. These might include recent support and resistance levels, trendlines, proximity to moving averages, etc.

One way to identify a good entry in bonds is through technical analysis, which primarily relies on the chart’s reflection of past movement. Many other traders use this technique, so traders often equally anticipate rises and falls in the market as price moves past key chart levels. These might include recent support and resistance levels, trendlines, proximity to moving averages, etc.

Another way of analyzing good entry levels for bonds is to use more of a fundamental approach. Different from technical analysis, fundamental analysis uses knowledge and data about the market to make entry and exit decisions. For example, fundamental knowledge might imply a seasonal aspect to entering or exiting a market. Also, news events, and especially data points, can provide information that can influence a fundamental analyst’s trades.

This includes detailed information about a company that may be offering a bond. Or it may be facts and figures relating to the economy of the government issuing the bonds.

Rather than getting into those details, which can be a lot of work, many traders rely on common cause and effect patterns that influence the market. One of those examples is the relationship, or actually, the inverse relationship between the stocks and bonds market. They’re both impacted in different ways by changing interest rates.

Let me explain.

Understanding the Pendulum

The Federal Open Market Committee, or FOMC, is responsible for maintaining a healthy amount of growth in the economy. If the economy isn’t doing well, they can heat up spending by making money easier to borrow. They do this by lowering the interest rate, known as the federal funds rate or the discount rate, making it less expensive to borrow money. When money is less costly to borrow, it drops the interest rate on credit cards, and increases the amount of disposable income that retail customers have so they can spend more. Similarly, companies can find it easier to borrow money to start projects or expansions that otherwise might have been too expensive to borrow in order to fund. This causes the economy to expand.

Conversely, if the FOMC feels the market is moving too fast and risking runaway inflation, they can increase the interest rate, making it costlier to borrow money. Therefore, consumers have less disposable income, as do companies, spending declines, creating a cooling effect on the economy. As companies spend less, and perhaps show smaller gains, stock holders may perceive that a company is cutting back and becoming less valuable. When it happens widely across the economy, this has the effect of lowering the stock market valuation.

Plus, with interest rates rising, saving money to get bank interest takes some investors’ funds away from the stock market and back into savings. Those knowledgeable about the bonds market can put money into bonds, to take advantage of the interest rate increase and better returns.

Plus, with interest rates rising, saving money to get bank interest takes some investors’ funds away from the stock market and back into savings. Those knowledgeable about the bonds market can put money into bonds, to take advantage of the interest rate increase and better returns.

This commonly-known inverse relationship between the stock market and the bonds market is a bond pendulum. It’s a great example of using Fundamental analysis when trading. Fundamentals traders can use this information to move money from the stock market to the bonds market and vice versa.

The wisest traders know that a combination of both Fundamental and Technical analysis techniques can help identify the sweet spot for entries and exits. They use the bias of fundamental knowledge and the timing of technical analysis to manage their portfolio balance.

Wise bond traders can also use longer-term analysis in their technical analysis approach to identify the underlying movement in the markets. For example, if we look at trend on a monthly chart, we can have a much longer-term view of the markets to consider, as we find major trend changes that can influence our shorter-term directional trades.

While many traders simplify this by thinking of the bonds and stock markets working opposite one another, it’s actually not quite that simple. Yes, the general inverse relationship is there, but knowing when we’re actually reversing and when it’s just a blip in the bigger picture is important.

This is where having a mentor can really help in understanding how the markets move. A good mentor can identify the critical factors that influence markets, as well as being able to recognize major moves from minor blips.

Having a Bonds Mentor is Key

One of our trading mentors recently identified a technical divergence that was in place months in advance of the recent market downturns. This was classified as a bearish divergence, which means that even though prices continued to move higher, there were indications in the market that showed the move higher was masking an underlying weakness in the markets. This allowed him and his students to anticipate this major change in market sentiment, ahead of the news outlets, giving the opportunity to take advantage of trading opportunities far in advance of the typical traders market mindset change.

That is, they were able to take advantage of this market move even while the rest of the news and general market opinions were buying as the markets rose.

Sure enough, the market stopped its ascent, and to the surprise of many, made a full 10% correction, followed by a 20% correction. While this surprised many, our mentors were already aware of it, and trading based on it for many weeks.

They were able to take profits near the peak, with confidence. They were also able to get into the opposite trades, for example, into bonds, well before other traders started thinking about exiting their long positions.

This is bonds trading using the best of fundamental, short-term technical, and long-term technical analysis. And it’s what’s needed to be able to not only make money in the stocks and bonds markets, but also to keep the gains before they disappear.

Would you have liked to have access to this information when our mentors did? Would you like to have had the confidence to take profits in your account to capture the gains before the stock markets turned south? What if you had the added knowledge of when and how to get into bonds to take advantage of the reversal.

This is your opportunity to do just that. If you’ve read this far, you’re obviously interested in getting better at bonds trading, and you want to learn how to ride the down moves in the stock market better so you can have greater potential for your account to grow in spite of pauses or drops in the stock market.

So it’s time to finally learn how to trade bonds, and how to find the sweet spots for well-timed entries and exits. Here’s your chance to do just that. Jump into our free live webinar this Saturday, February 9th at 10:00 am Eastern by [Expired] while we’re still accepting students. It’s your chance to even out those ups and downs in your portfolio, by learning a skill that you previously only heard of others doing. Act fast, as this is only available for a limited time, and we don’t want you to miss out on this opportunity. NOW is the time to learn, so you are ready and waiting for the next market turn.

Can you imagine actually looking forward to the next downturn in the economy?

Can you imagine bringing in a new level of safety through risk reduction in your portfolio? Having the right level of safety in anyone’s portfolio is important. It’s especially important as you near retirement!

Learn now how a better understanding of bonds and how to trade them can make a real difference in your portfolio.

0 Comments